"From 2020 April businesses will use MTD compliant software to file their HMRC VAT returns. Be prepared and join our future-ready practical courses."

UK government take the initiative in Making Tax Digital, that sets out a vision for the 'end of the tax return' and an altered tax system' by 2020. HMRC states that the primary goal of MTD is to make tax administration more efficient, more professional and more straightforward for taxpayers.

What is MTD? And how it affect business in 2020?

Making Tax Digital (MTD) is one of the government’s current desired plans to make it easier for individuals & businesses to get their taxes right by making it more effective, efficient and user-friendly for taxpayers to be putting accurate taxes. Over the years, customers have been struggling to produce accurate data which has cost Exchequer (Governments current account) almost £9 billion a year to rectify. Due to this, many VAT-registered businesses with a taxable turnover above the VAT threshold of £85,000 are now required to use the Making Tax Digital service to keep records digitally and use software compatible with MTD to submit their VAT Returns.

Why Making Tax Digital?

The government has announced that, in the year 2020, it is mandatory for accountants to have knowledge and experience in using computerized software’s such as Sage, Xero, and QuickBooks etc as companies are adapting to the modern-day technology. The reason could be because technology is changing rapidly, diminishes costs and will be an efficient method of producing financial output for monthly reports so it’s vital for users to familiarize with it immediately. As these are online, it will be easier for different people to access accounting data outside of the office, securely. Physical copies are not required so no data will be lost, damaged or stolen. Once the data is entered into the system, all the calculations are done automatically by the software so data entry errors will be minimal.

Companies Intensions Regarding Digital Accounting

Nowadays companies (regardless of size) are not interested in hiring employees with an awareness of using manual accounting. According to an article, 58% of large companies use computerized accounting and 100% of the cloud-based accounting consumers saw a 15% over year revenue growth. Organizations feel that they can benefit from understanding the trends of accounting solutions so to minimize costs, improve time management and be better prepared for future changes in accounting. This helps to simplify the collaboration with clients and improves the quality of service and increasing client satisfaction.

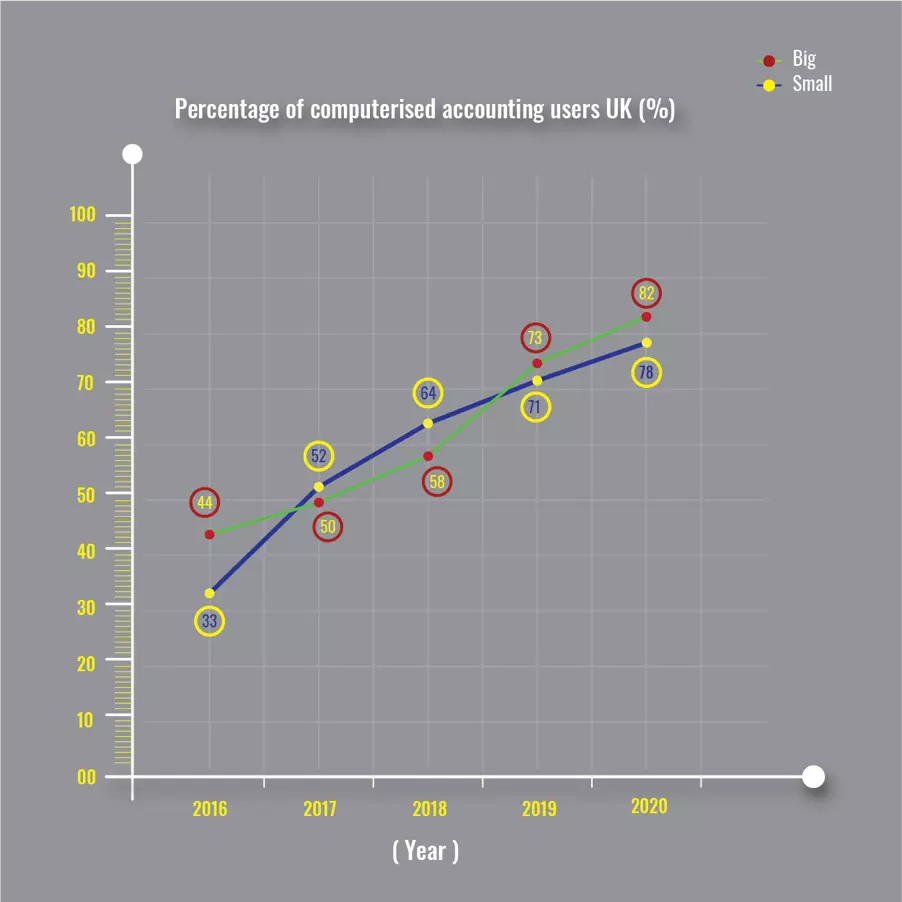

The line graph is to show the growth rate of using accounting software’s for both small & big businesses over the years. This line graph indicates a steady increase in the number of small businesses using cloud-based accounting. It is estimated that by 2020 around 78% of small businesses will mainly use computerized accounting. The reason small businesses had a lower percentage in 2016 is because they were not aware of and didn’t know how to function the software.

From looking at the two sets of charts Sage is well renowned worldwide with 23 million despite having the least number of users in the UK. Even though, QuickBooks has the highest number in the UK of 44% it is the lowest compared to Sage and Xero globally. The three software are very popular but still more people should be encouraged in using online instead of manual accounting. One of the reasons is potentially because, people cannot afford to purchase laptops or computer some of the facilities are inaccessible in certain locations and lack of education on the software. Smaller businesses do not prefer to use Sage as it is technical and not compatible with mobile devices such as smart phones and tablets. However Sage is popular especially in large businesses due to the fact that there are a lot of features tailored to their needs and its known user-friendliness.

MTD implementation

For this concept to be implemented, companies are keeping digital records and providing updates to HMRC to prevent these errors from occurring regularly. The government has also mentioned that businesses will be supported throughout the transition period and that they will not be authorizing Making Tax digital for any businesses in 2020. This means that users are not allowed to use Excel to be sending taxes to HMRC and will need to purchase software to prevent from facing any consequences. Taxes will be visible to access anytime and businesses won’t need to wait until the end of the tax year to know how much tax they will have to pay upon filing a return. In addition to this, they can avoid small errors which could result in bigger problems.

However, for this project to be a success, companies will need to start using computerized accounting systems as paper-based will not be permitted for the VAT. Despite manual accounting declining, people still prefer to use this method as they are struggling to adapt to modern technology and have a lack of knowledge on current accounting software’s. As well as that some businesses are not aware of the changes being made. Users will not like this concept because they may be experienced established accountants but have lack of knowledge on using the computerized version. The news website; accountancy age mentions an article about QuickBooks promoting MTD for more people to be doing their taxes online. Small businesses are vulnerable financially so by having oversight on their taxes, they will be able to identify the issues for it to be resolved immediately for them to be stable and grow.

How we can help you?

Therefore, training will be required on electronic accounting to attract high profile companies to be recruiting you. Future Connect Training offers practical computerized accounting training where students can gain skills and an understanding of the various types of software’s available to entice major companies into recruiting them. Each program has its strengths and will definitely benefit any business owner or accounting professional. The programs we offer include practical hands-on training given by certified professionals that will give a real-world work experience which will help you to get ready to do your work confidently. In each of these software’s, we focus on the functions that are common in modern-day organizations to ensure that you will be prepared and gain enough experience to specialize in them.

Checkout our Industry-specific training programs here. We have centers based in London and Birmingham. Contact us at 02037908674 or 01212959988 to book a free consultation session. You can also email us any questions at support@fctraining.org or visit our website www.fctraining.org for any other information.