Introduction to IAS 8

IAS 8 (International Accounting Standard 8) is a standard developed by the International Accounting Standards Board (IASB) that provides guidance on the accounting policies, changes in accounting estimates and errors that an entity should apply when preparing its financial statements. This standard helps in ensuring the consistency and comparability of financial statements across different entities.

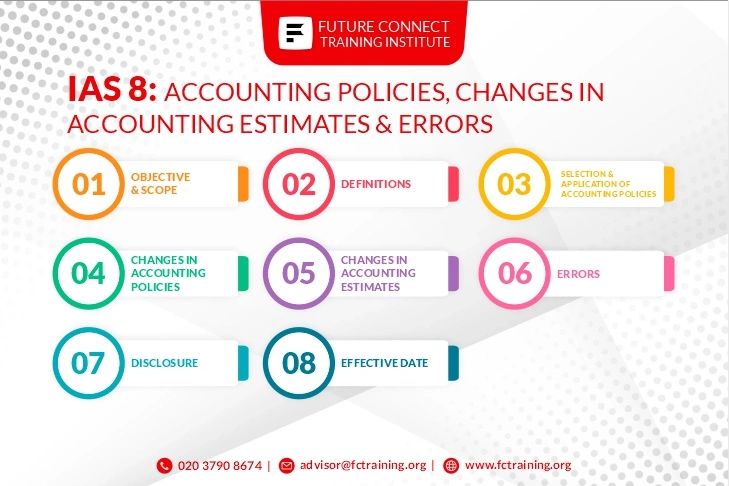

Scope of IAS 8

IAS 8 applies to all types of entities, including corporations, partnerships, and sole proprietorships. It applies to all financial statements that are prepared in accordance with International Financial Reporting Standards (IFRS).

Accounting Policies

IAS 8 requires entities to use consistent accounting policies for similar transactions, events, and conditions. The standard provides guidance on how to select accounting policies that are appropriate for the entity's circumstances and how to apply them consistently. It also requires entities to disclose their accounting policies in their financial statements.

Changes in Accounting Policies

If an entity changes its accounting policies, it must apply the new policy retrospectively, unless doing so is impracticable. The entity should adjust the opening balances of affected assets, liabilities, and equity, as well as any comparative information presented in the financial statements. The effect of the change in accounting policy should be disclosed in the financial statements.

Changes in Accounting Estimates

IAS 8 defines accounting estimates as "the monetary amount assigned to an item in the financial statements, based on the judgment of the management of the entity". Changes in accounting estimates should be reflected in the financial statements in the period in which the change occurs, if the change affects only that period or in the period of the change and future periods, if the change affects both. The entity should disclose the nature and amount of the change in accounting estimates in the financial statements.

Errors

IAS 8 defines errors as "omissions or misstatements in the financial statements resulting from a failure to use, or misuse of, reliable information that was available to, or could reasonably be expected to have been obtained by, the entity". If an entity discovers an error in its financial statements, it must correct the error retrospectively. The correction should be made to the comparative information presented in the financial statements for the prior period. The effect of the correction should be disclosed in the financial statements.

Disclosure Requirements

IAS 8 requires entities to disclose the following in their financial statements:

- The significant accounting policies used by the entity

- Any changes in accounting policies and the reasons for those changes

- Any changes in accounting estimates and the reasons for those changes

- Any errors discovered and the effect of the correction of those errors

Conclusion

IAS 8 helps in ensuring the consistency and comparability of financial statements across different entities. It provides guidance on the selection and application of accounting policies, changes in accounting estimates and errors that an entity should apply when preparing its financial statements. It also requires entities to disclose their accounting policies, changes in accounting policies, changes in accounting estimates, and errors in their financial statements. By following IAS 8, entities can produce financial statements that are reliable and useful to users in making economic decisions.

FAQs

Frequently Asked Questions about IAS 8

IAS 8 stands for International Accounting Standard 8. It is a standard developed by the International Accounting Standards Board (IASB) that provides guidance on the accounting policies, changes in accounting estimates and errors that an entity should apply when preparing its financial statements.

IAS 8 applies to all types of entities, including corporations, partnerships, and sole proprietorships. It applies to all financial statements that are prepared in accordance with International Financial Reporting Standards (IFRS).

IAS 8 requires entities to use consistent accounting policies for similar transactions, events, and conditions. The standard provides guidance on how to select accounting policies that are appropriate for the entity's circumstances and how to apply them consistently. It also requires entities to disclose their accounting policies in their financial statements.

If an entity changes its accounting policies, it must apply the new policy retrospectively, unless doing so is impracticable. The entity should adjust the opening balances of affected assets, liabilities, and equity, as well as any comparative information presented in the financial statements. The effect of the change in accounting policy should be disclosed in the financial statements.

IAS 8 defines accounting estimates as "the monetary amount assigned to an item in the financial statements, based on the judgment of the management of the entity". Changes in accounting estimates should be reflected in the financial statements in the period in which the change occurs, if the change affects only that period or in the period of the change and future periods, if the change affects both. The entity should disclose the nature and amount of the change in accounting estimates in the financial statements.

IAS 8 defines errors as "omissions or misstatements in the financial statements resulting from a failure to use, or misuse of, reliable information that was available to, or could reasonably be expected to have been obtained by, the entity". If an entity discovers an error in its financial statements, it must correct the error retrospectively. The correction should be made to the comparative information presented in the financial statements for the prior period. The effect of the correction should be disclosed in the financial statements.

IAS 8 requires entities to disclose their significant accounting policies, any changes in accounting policies and the reasons for those changes, any changes in accounting estimates and the reasons for those changes, and any errors discovered and the effect of the correction of those errors in their financial statements.

How Future Connect Training's Management Accounts Training can help in this?

- Future Connect Training offers Management Accounting training courses that cover the principles and techniques of management accounting, which can be helpful for entities to apply IAS 8.

- The course covers various topics such as cost-volume-profit analysis, budgeting, variance analysis, and performance measurement, which are essential for entities to make informed decisions regarding their accounting policies, estimates, and errors.

- By attending the Management Accounting training courses, individuals can gain a deeper understanding of accounting policies, estimates, and errors and learn how to apply these principles to their entity's financial statements, thus helping to ensure compliance with IAS 8.

- Moreover, the course can equip individuals with the necessary skills to identify and analyze the impact of accounting policies, estimates, and errors on financial statements, thus enabling them to make informed decisions that can positively impact the entity's financial performance.

- Overall, Future Connect Training's Management Accounting training can provide individuals with the knowledge and skills to apply IAS 8 principles and techniques, leading to more accurate financial reporting and improved financial performance for the entity.