Introduction

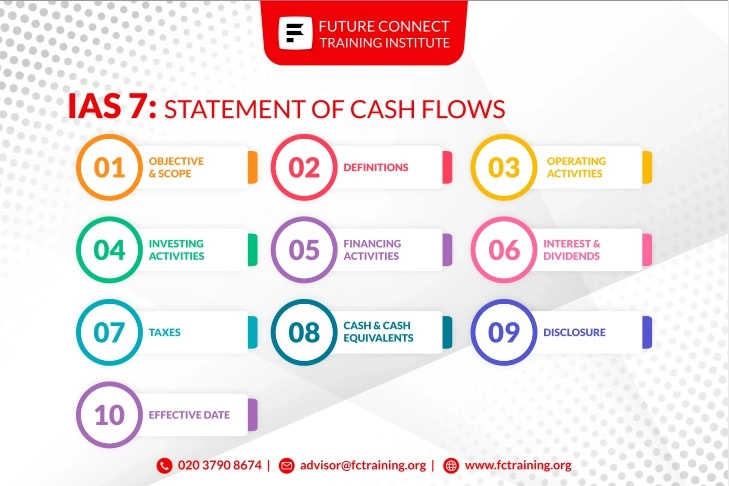

The International Accounting Standards Board (IASB) issued IAS 7, Statement of Cash Flows, to provide guidance on the presentation of cash flows from operating, investing, and financing activities. The standard aims to enhance the relevance and reliability of financial statements by providing information about an entity's liquidity, solvency, and financial adaptability. IAS 7 was first issued in 1992, and has undergone revisions in 1994, 1998, 2004, and 2016.

Purpose

The primary purpose of IAS 7 is to provide information to users of financial statements about an entity's cash inflows and outflows during a period. The standard requires entities to prepare a statement of cash flows, which classifies cash flows into three categories: operating, investing, and financing activities. The statement of cash flows provides information that assists users in evaluating an entity's ability to generate cash and cash equivalents and its ability to meet its financial obligations.

Scope

IAS 7 applies to all entities that prepare financial statements in accordance with International Financial Reporting Standards (IFRSs). The standard requires entities to present a statement of cash flows for each period for which financial statements are presented.

Classification of Cash Flows

IAS 7 requires entities to classify cash flows into three categories: operating, investing, and financing activities.

Operating Activities

Cash flows from operating activities refer to cash inflows and outflows that arise from the ordinary activities of an entity. Operating activities generally include the cash effects of transactions that affect the determination of net profit or loss. Examples of cash inflows from operating activities include cash received from customers, interest received, and dividends received. Examples of cash outflows from operating activities include payments to suppliers, employees, and taxes paid.

Investing Activities

Cash flows from investing activities refer to cash inflows and outflows that arise from the acquisition and disposal of long-term assets and other investments that are not considered cash equivalents. Examples of cash inflows from investing activities include proceeds from the sale of property, plant, and equipment, and proceeds from the sale of investments. Examples of cash outflows from investing activities include payments to acquire property, plant, and equipment, and payments to acquire investments.

Financing Activities

Cash flows from financing activities refer to cash inflows and outflows that arise from the activities of an entity's owners and creditors. Examples of cash inflows from financing activities include proceeds from the issuance of debt and equity instruments. Examples of cash outflows from financing activities include repayments of debt, dividends paid, and payments to purchase treasury shares.

Presentation of the Statement of Cash Flows

IAS 7 requires entities to present a statement of cash flows as an integral part of the financial statements. The statement of cash flows should present cash flows during the period classified into operating, investing, and financing activities. Entities may choose to present the statement of cash flows using either the direct or indirect method.

Direct Method

Under the direct method, entities present major classes of gross cash receipts and gross cash payments, such as cash received from customers and cash paid to suppliers, respectively.

Indirect Method

Under the indirect method, entities start with profit or loss and adjust for non-cash transactions and other items, such as depreciation and changes in working capital.

Conclusion

In conclusion, IAS 7 provides guidance on the presentation of cash flows from operating, investing, and financing activities. The standard requires entities to prepare a statement of cash flows, which provides information about an entity's ability to generate cash and meet its financial obligations. The statement of cash flows is an integral part of the financial statements and should be presented using either the direct or indirect method. Compliance with IAS 7 ensures the consistency and comparability

FAQs

Frequently Asked Questions about IAS 7

IAS 7 is a standard issued by the International Accounting Standards Board (IASB) that provides guidance on the presentation of cash flows from operating, investing, and financing activities.

IAS 7 applies to all entities that prepare financial statements in accordance with International Financial Reporting Standards (IFRSs).

The primary purpose of IAS 7 is to provide information to users of financial statements about an entity's cash inflows and outflows during a period.

The three categories of cash flows under IAS 7 are operating, investing, and financing activities.

Operating activities refer to cash inflows and outflows that arise from the ordinary activities of an entity, such as cash received from customers and payments to suppliers.

Investing activities refer to cash inflows and outflows that arise from the acquisition and disposal of long-term assets and other investments that are not considered cash equivalents.

Financing activities refer to cash inflows and outflows that arise from the activities of an entity's owners and creditors, such as proceeds from the issuance of debt and payments to purchase treasury shares.

The statement of cash flows should be presented as an integral part of the financial statements and should classify cash flows into operating, investing, and financing activities.

The two methods of presenting the statement of cash flows under IAS 7 are the direct method and the indirect method.

The direct method presents major classes of gross cash receipts and gross cash payments, while the indirect method starts with profit or loss and adjusts for non-cash transactions and other items.

How Future Connect Training, Bookkeeping and VAT Training can help in understanding IAS 7?

Future Connect training, Bookkeeping and VAT training can be helpful in understanding IAS 7 in different ways:

- Future Connect Training: Future Connect is a training provider that offers courses in finance, accounting, and bookkeeping. Their courses cover a wide range of topics, including financial reporting, budgeting, and taxation. By taking their courses, you can gain a better understanding of accounting principles and financial reporting requirements, which will help you to understand the requirements of IAS 7.

- Bookkeeping: Bookkeeping is the process of recording and maintaining financial transactions. It involves recording all financial transactions in a company's books, including sales, purchases, and payments. Understanding bookkeeping is essential for understanding IAS 7, as the standard requires companies to prepare a statement of cash flows, which relies heavily on accurate bookkeeping records.

- VAT Training: Value-added tax (VAT) is a type of consumption tax that is applied to goods and services. Understanding how VAT works is important for understanding IAS 7 because it is a key factor in determining the cash inflows and outflows of a company. A company's VAT payments and refunds can have a significant impact on its cash position, which is reflected in the statement of cash flows.

In summary, Future Connect trainings can help in understanding IAS 7 by providing a broader understanding of accounting principles and financial reporting requirements. Bookkeeping is essential for understanding IAS 7, as it is the foundation of accurate financial reporting. VAT training can help to understand the impact of VAT on a company's cash position, which is reflected in the statement of cash flows.