Introduction

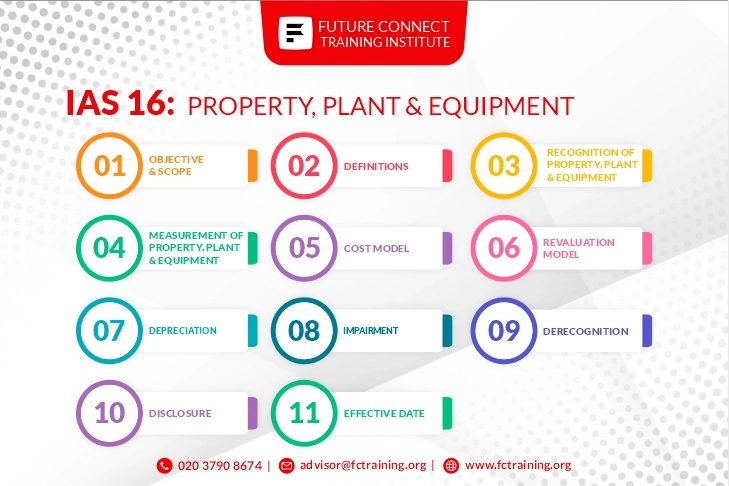

IAS 16 Property, Plant, and Equipment, is an International Accounting Standard that provides guidance on the recognition, measurement, and disclosure of property, plant, and equipment (PPE) in an entity's financial statements. PPE refers to tangible assets that are held by an entity for use in the production or supply of goods or services, for rental to others, or for administrative purposes. This technical write-up provides an overview of IAS 16 and explains its key requirements.

Scope

IAS 16 applies to all PPE except for the following:

- PPE that is classified as held for sale in accordance with IFRS 5 Non-current Assets Held for Sale and Discontinued Operations.

- Biological assets related to agricultural activity and bearer plants.

- Mineral rights and mineral reserves such as oil, natural gas, and similar non-regenerative resources.

- Exploration and evaluation assets.

Recognition of PPE

PPE should be recognized as an asset if, and only if:

- It is probable that future economic benefits associated with the asset will flow to the entity, and

- The cost of the asset can be measured reliably.

Measurement

PPE should be measured at cost less accumulated depreciation and accumulated impairment losses. The cost of PPE includes its purchase price, direct costs such as transport and installation, and any costs directly attributable to bringing the asset to its working condition for its intended use.

Subsequent Expenditures

Subsequent expenditures on PPE are capitalized if they meet certain criteria. These criteria include whether the expenditure will result in future economic benefits to the entity, whether the cost of the expenditure can be measured reliably, and whether the asset's carrying amount will increase as a result of the expenditure.

Depreciation

Depreciation is the systematic allocation of the cost of an asset over its useful life. The useful life of an asset is the period over which it is expected to be used by the entity. The residual value of an asset should be estimated and subtracted from its cost to determine the depreciable amount. The depreciable amount is then allocated over the asset's useful life using a suitable depreciation method. The choice of depreciation method should reflect the pattern of consumption of the asset's future economic benefits.

Impairment

An entity should assess at each reporting date whether there is any indication that PPE may be impaired. If such an indication exists, the entity should estimate the recoverable amount of the asset. The recoverable amount is the higher of the asset's fair value less costs to sell and its value in use. If the recoverable amount is less than the carrying amount of the asset, the asset is impaired and should be written down to its recoverable amount.

Disclosure

An entity should disclose the following information in its financial statements regarding PPE:

- The measurement basis used for PPE.

- The depreciation method used.

- The useful lives or depreciation rates used.

- The gross carrying amount and accumulated depreciation of PPE.

- Reconciliation of the carrying amount of PPE at the beginning and end of the period.

- The carrying amount of any impaired PPE.

- The amount of any commitments for the acquisition of PPE.

Conclusion

IAS 16 provides clear guidance on the recognition, measurement, and disclosure of PPE. The standard helps to ensure that entities provide relevant and reliable information about their PPE in their financial statements, thereby enhancing transparency and comparability.

FAQs

Frequently Asked Questions about IAS 16

IAS 16 is an International Accounting Standard that provides guidance on the recognition, measurement, and disclosure of property, plant, and equipment (PPE) in an entity's financial statements.

IAS 16 applies to all PPE except for PPE that is classified as held for sale in accordance with IFRS 5 Non-current Assets Held for Sale and Discontinued Operations, biological assets related to agricultural activity and bearer plants, mineral rights and mineral reserves, and exploration and evaluation assets.

PPE should be recognized as an asset if it is probable that future economic benefits associated with the asset will flow to the entity, and the cost of the asset can be measured reliably.

PPE should be measured at cost less accumulated depreciation and accumulated impairment losses. The cost of PPE includes its purchase price, direct costs such as transport and installation, and any costs directly attributable to bringing the asset to its working condition for its intended use.

Subsequent expenditures on PPE are capitalized if they meet certain criteria. These criteria include whether the expenditure will result in future economic benefits to the entity, whether the cost of the expenditure can be measured reliably, and whether the asset's carrying amount will increase as a result of the expenditure.

Depreciation is the systematic allocation of the cost of an asset over its useful life.

An entity should assess at each reporting date whether there is any indication that PPE may be impaired. If such an indication exists, the entity should estimate the recoverable amount of the asset. The recoverable amount is the higher of the asset's fair value less costs to sell and its value in use. If the recoverable amount is less than the carrying amount of the asset, the asset is impaired and should be written down to its recoverable amount.

An entity should disclose information about the measurement basis used for PPE, the depreciation method used, the useful lives or depreciation rates used, the gross carrying amount and accumulated depreciation of PPE, reconciliation of the carrying amount of PPE at the beginning and end of the period, the carrying amount of any impaired PPE, and the amount of any commitments for the acquisition of PPE.

How Future Connect Training's Final Accounts Training can help in understaing IAS 16?

- The final accounts training can be useful in understanding IAS 16 as it provides a solid foundation for understanding financial statements, including the balance sheet which reports an entity's assets, liabilities, and equity. IAS 16 provides specific guidance on how to recognize, measure, and disclose property, plant, and equipment (PPE) in an entity's financial statements, which is an important component of the balance sheet.

- During the final accounts training, participants learn about the different types of assets, including PPE, and how they are measured and reported in the financial statements. They also learn about depreciation, which is a key concept in IAS 16 as it outlines how the cost of PPE should be allocated over its useful life.

- Moreover, the training can help participants understand the importance of reliable measurement of costs associated with PPE, as well as the treatment of subsequent expenditures on PPE. Participants can also learn how to assess impairment of PPE and the disclosure requirements for PPE.

- Overall, the final accounts training provides a strong foundation for understanding the principles and concepts outlined in IAS 16, which can help participants better understand and apply the standard in practice.